There may be certain situations where you need to adjust or remove tax from all sales. For example, you may not require GST or any form of tax to be applied to your sales.

If this is the case, you can adjust your tax rate to 0%. When the time comes to begin applying tax, you can quickly change your tax rate to suit your requirements.

To adjust your tax rate

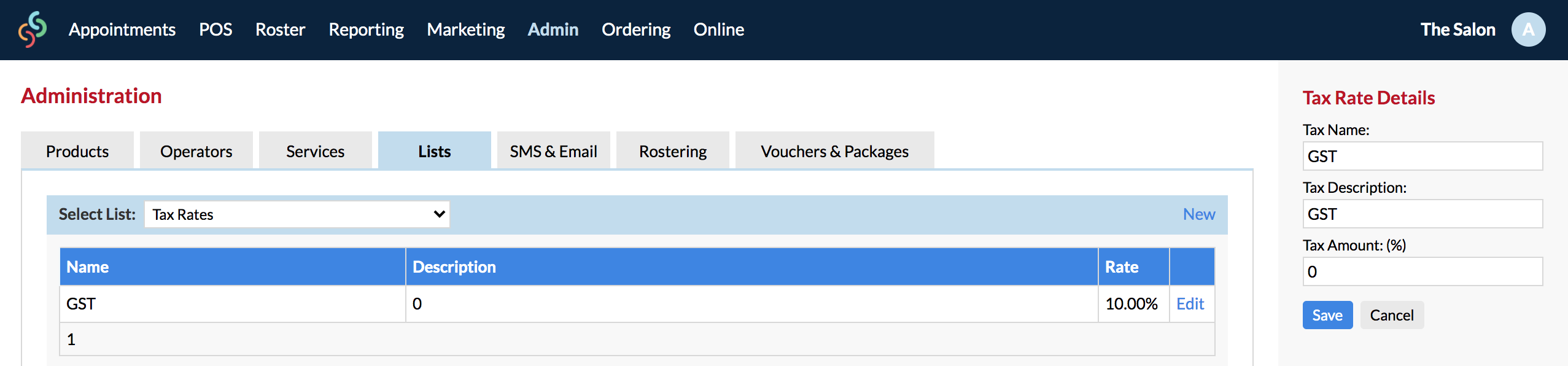

Head on over to Admin > Lists and select the Tax Rates option from the Select List drop down.

We can now see that we have a tax rate called GST and we'd really like to change the tax rate to 0% for any future sales.

To do this, click Edit in the far right of the tax row and adjust the tax rate to 0%:

Click Save to update the changes.

Great! Any future transactions you process will now be tax free. You can check this out in the Sales Report in Reporting > Report List after processing some new transactions.

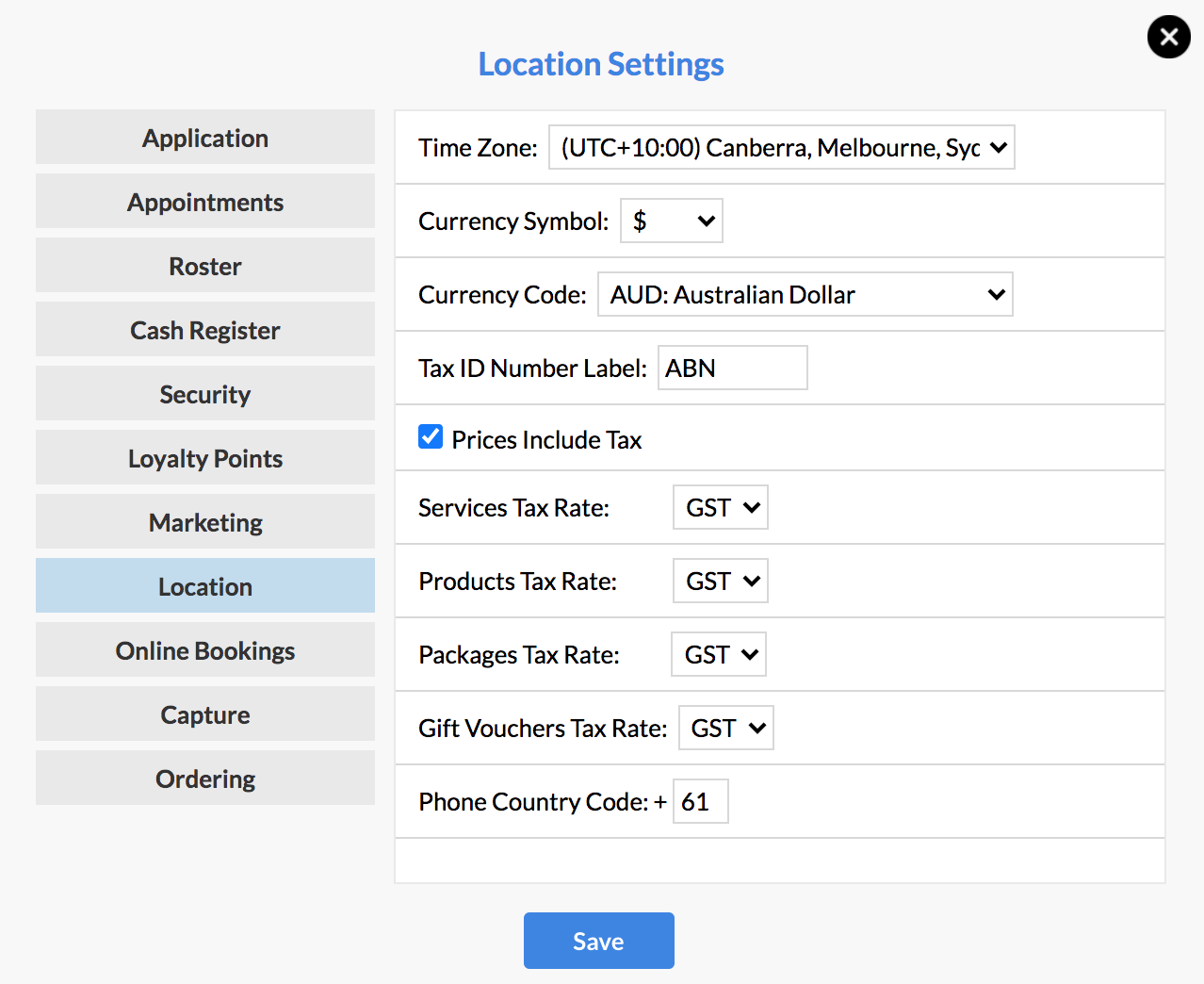

If you would like to see which sale items are connected to a tax rate, simply head over to Settings > Location Settings and scroll to the bottom of the pop up which appears:

If you reach a stage where you would like to implement the tax rate again, simply repeat the steps, replacing the 0% tax rate with the new tax rate required.

It is important to note that this action won't automatically apply tax to previous transactions and that you won't be able to bulk update transactions for the new tax rate.

If you need to manually update your transactions, click here to view how.

If you have any questions, please send them to us via the Submit a Request option in your Help & Support page—we're here to help.